FOR THOSE FINANCIALLY IMPACTED BY COVID

On June 17, 2020, Governor Cuomo signed the Emergency Rent Relief Act of 2020. The Act creates the COVID Rent Relief Program to help those impacted by COVID-19 with their rental payments. New York has set aside $100,000,000 for this program. The program will provide a one-time rental subsidy directly to a tenant’s landlord or housing provider. Tenants will not be required to repay any assistance received. The program, which is being administered by the New York State Division of Homes and Community Renewal (“HCR”), opens on July 16, and will take applications for two weeks. You can sign up to be notified when the application is available.

The program is intended to assist below median applicants whose income has been impacted during the COVID crisis to pay the additional “rent burden” they face as a result of the change in their financial circumstances.

To qualify for the program, applicants must meet all of the following eligibility requirements:

- Must be a renter with a primary residence in New York State.

- Before March 1, 2020 and at the time of application, household income (including unemployment benefits) must be below 80 percent of the Area Median Income, adjusted for household size. The Area Median Income is based upon the county of residence, and can be found on the Homes and Community Renewal website here.

- Before March 1, 2020 and at the time of application, the household must have been “rent burdened,” meaning that more 30 percent% of the gross monthly income is paid towards rent.

- Applicants must have lost income during any period between April 1, 2020 and July 31, 2020.

- At least one member of the household must have U.S. Citizenship or an eligible immigration status.

- Rent an apartment, single family home, manufactured home, or manufactured home lot.

You are not eligible if you reside in public housing or if you receive Section 8 Housing Choice vouchers. If you receive Section 8 vouchers, your rent exceeds 30% of your income, and you have lost income for the period described above, HCR advises that you should contact your voucher administrator to request an adjustment to your rental payment standard.

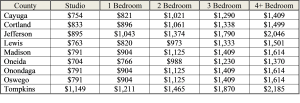

For area counties, the median income, based on family size, is as follows:

When reviewing applications, HCR will prioritize households with the greatest economic and social need, accounting for income, rent burden, percent of income lost and risk of homelessness.

Household income is based on the gross income of all members of the household, and includes

salaries, wages, tips, recurring gifts, unemployment benefits, and other government benefits for all members of a household. It also includes Pandemic Unemployment Assistance (PUA) and Pandemic Unemployment Compensation (PAC). Households do not have to include employment income for minor children under 18 years old, or for children who are 18 or older and full-time students. It also does not include foster care payments or supplemental nutrition assistance program benefits (SNAP).

Someone who lives with one or more roommates may apply for rental assistance under the program, but may only apply for assistance for that portion of the rent payment for which they are personally responsible on a monthly basis. If more than one roommate is applying for assistance, they must apply as a household.

The program will pay a one-time rental subsidy that covers the difference in the applicant’s household rent burden between March 1, 2020 and the rent burden for the months for which assistance is sought. Therefore, if an applicant’s income decreased in any of April, May, June, or July, they may apply for assistance for the difference in their rent burden for any of the affected months. The maximum assistance available under this program is four months. Your rent burden is the amount of your income paid towards rent that is over 30% of your gross income.

For example, an applicants’ rent is $700 a month, and their total monthly household income was $2,000 prior to the pandemic. That means that on March 1, 2020, they were paying 35% of their income towards rent [$700/$2000], and their rent burden was $5% [35%-30%], or $100 [$2,000*5%]. Today, due to a reduction in their hours, the applicants’ monthly income has decreased to $1,400, and their rent remains the same. This means that they are now paying 50% of their income towards rent, and their rent burden is 20% [50%-30%], which is $280 [$1,400*20%]. The applicant would therefore be eligible for a subsidy that covers the 15% increase in their rent burden of $180.

However, the subsidy amount available is capped. The cap is based on the rental rate, which may not exceed 125% of the fair market rents for the county. The fair market rents are calculated by HUD, and available at the following link: https://www.hcr.ny.gov/rent-caps-125-fmr-crrp.

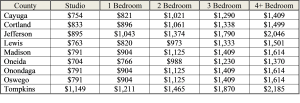

For area counties, the following 125% of fair market rental values apply:

If someone in Onondaga County has a one bedroom apartment, the rent cap will be $904. Therefore, an applicant monthly rent is under $904 will receive the full value of any subsidy for which they are eligible. But if an applicant’s rent is more than the monthly cap, they are still eligible for a subsidy, however, it will be subject to the cap. This means that for if someone pays $950 a month for a one bedroom apartment, they will receive the subsidy up to $904, but not for the full $950 since they are $46 over the cap.

To apply for the subsidy, applicants will need to provide a copy of their lease or other proof of their monthly rental amount, and proof of their household’s gross income prior to March 1, 2020 and at present. This can be done through paystubs, employer letters, tax returns, etc. Tenants who do not have a written lease will need to provide proof of a rental obligation or complete the Tenant Rent Attestation, which is available on the application portal. It is possible to provide a letter from the landlord stating the monthly rent.

For those who are awarded a subsidy, HCR anticipates sending payments to landlords by the end of the summer. In the meantime, tenants should continue to pay their full rent, as the subsidy will only pay a portion of the rent owed. If a tenant has paid their rent from April 1, 2020 to July 31, 2020, they may still receive assistance. In that case, they will have the option to apply the subsidy as a prepayment to future rent, beginning August 1, 2020, or to repay any security deposit that was used to pay rent.

Once an applicant has been selected to receive assistance, they will be notified simultaneously along with their landlord that the subsidy is being dispersed. The notification will state the

amount of assistance, the timeline for receipt, and how the tenant has chosen to have additional funds credited if the rent has already been paid in whole or in part. Applicants will receive a notice when their landlord has been paid the subsidy, which should be retained in the event their landlord tries to assert a claim for nonpayment.

Landlords are required to accept funds received under this program, and may not discriminate against any tenants for participating in this program. If a landlord refuses to accept the subsidy or discriminates against the tenant because of it, the tenant may file a discrimination complaint with the State Division of Human Rights at www.dhr.ny.gov/complaint.

Finally, any funds received under this program will not be counted towards a recipient’s annual household income for purposes of public benefits or other public assistance.

For more information and to apply for the COVID Rent Relief Program, go to the HRC website at https://hcr.ny.gov/RRP.

If you have any questions about the Rent Relief Act, or are facing financial difficulties and would like to discuss whether bankruptcy is an option, please contact Elizabeth Genung, Esq. at (315) 422-1311 or [email protected]